Maximising benefit uptake and what works

As part of the charity’s wider vision to design out poverty in the communities we support, we endeavour to eliminate the occurrence of financial crises that individuals in communities face. These crises are multi-faceted which requires us, as an organisation, to consider how we play our part in influencing wider systemic change. However, our core purpose is to address some of the causes of crisis, support long term prevention and recovery to ensure individuals know where crisis support is available. It’s that last part that underpins our work to develop Money Angels and the Angels Connect platform. We hope the potential to connect people to support when they need it most in an effective and sustainable way will resonate with you as you read on.

—

As an organisation we have a strong reputation in the North-West and beyond for helping people build financial resilience through the equipping, enabling, and then empowering of community members to provide the stepping stones towards the technical support that is provided via debt and welfare benefits advice support services.

Welfare Benefit related challenges

Understanding some of the live challenges that are faced in the advice sector further supports our assertion that the Money Angels is game changing for the sector, communities, and most importantly the individuals we support.

Currently, our organisations benefits advice team are working to support clients with a significant number of PIP refusals where it seems that the decision maker has not appeared to have even looked at the claim properly, and as such the amount of appeal work that they are involved in has dramatically increased, particularly in the last 18 months.

The team regularly reflect on the high volume of individuals who find themselves either struggling as a result of historic tax credits overpayments, or even having to engage the support of our debt advice team to manage this debt. This is a new challenge and has come about at the point a tax credit claimant is moved over to Universal Credit. At this point when reviewing the claim, more often than not it becomes apparent that the claimant has been paid incorrectly. These cases are particularly complex and take a significant amount of time to rectify.

Our team tell us that in the last 18 months the volume and complexity of referrals has increased – this is a challenge that extends to our debt advice team too. Put simply, more people are finding themselves at point of crisis and in need of support.

The team anticipate the demand for the support they offer will significantly increase as residents are migrated over to Universal Credit. The headline challenges that this has already presented include:

- a deficit in the digital literacy required to make the UC claims

- the very real prospect of individuals falling into debt while they are awaiting their first UC payment

- and for individuals whose complex circumstances mean they can’t engage with the system changes - their benefits will simply stop if they do not take the steps required of them

Our approach balances a desire to promote holism – connecting the individual not just to a service provision, but to a community response that will see them supported to a position where their financial status is more secure. Through the equipping and enabling of individuals rooted in communities, we are able to maintain connection and support sustained financial resilience.

Money Angels are volunteer community members in any setting who are trained to have guided, intentional conversations in community spaces with those identified as in need of support, with then the resource to connect directly to the technical support available via specialist debt and benefits advisors, which supports a commitment to compliance and excellence when it comes to the provision of specialist support for those requiring debt advice, advice with welfare benefits, and any referrals to additional support services as required.

Our model

Money Angels is rooted in our organisations 21 years’ experience in developing a community based model for the charity’s money advice service.

At the heart of the Money Angels model is free, impartial, relational face-to-face money advice, supported by members of the community who are equipped, enabled, and empowered to support the process from identifying need, to the connection with the technical support available to bring about change. This aspect of locally rooted people providing support to other locally rooted people is a key distinctive of our approach.

Money Angels are community members in any setting who are trained to have guided, intentional conversations in community spaces with those identified as in need of support.

Angels Connect is the resource to connect Money Angels directly to the technical support from a debt or benefits advisor. This supports our commitment to compliance and excellence when it comes to the provision of specialist support for those requiring advice.

Angels Connect comprises of a web-based platform that includes: bitesize 30 minute training programme for Money Angels, a social network, and a referral app that can be adapted to suit the needs of the service that will receive Money Angels referrals.

Angels Connect been produced to a standard that we have built on our outstanding reputation for over the last 21 years. Money Angels are supported to provide specified guidance which connects people to specialist support via a debt or welfare benefits adviser.

Money Angels open the gate in non-standard settings, triaging cases, and supporting the management of the referral flow into an advice service.

The core of the training that Money Angels engage with focuses on 16 themes that include: An overview of the benefits system, Why someone might need benefits advice, Benefit categories, What UC is, Whether someone should claim UC, Detail around Sanctions, Detail around appealing decisions, Trigger questions to ask individuals both from a benefits and debt point of view, What individuals may need to provide ahead of a benefit check with an, An overview of debt, Some signs and symptoms to look out for, Some details around impact and emotions, Detail around types of debt and their importance, Some information around the advice process, Key safeguarding information, Key privacy information

You will have noticed that this article focusses heavily on the welfare benefits advice part of our work to build financial resilience. This is because we know that when at crisis point, often the ‘underlying issue’ is not addressed, and this can cause people to need similar support again in the future. We’ve wanted to do more to stop people reaching crisis point again and this involves building deeper relationships in communities (via our Money Angels) by being clearly locally rooted.

We also know that preventing crisis in the first place is the most effective way of reducing the need for emergency intervention. In money management terms, prevention means effective education, but also better access to income maximisation work (especially welfare benefits).

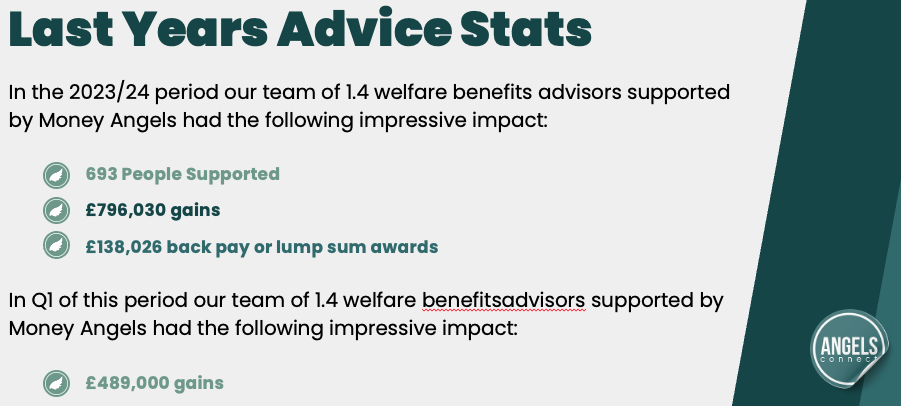

We’ve been working in this way for just under 18 months now and to give you an impression of the scale of output possible when it comes to this model, last year our team of 1.4 benefits advisors saw 693 people with total income maximised gains of £796,030.

Our team of 2.5 debt advisors connected with 752 people managing £6.3m of debt and writing of just under £2m of debt.

To give you a peak into the data from the first quarter of this year which, following tweaks to the Money Angels model, shows just what could be possible:

In 3 months our welfare benefits team (remember there is 1.4 of them) have supported people to make total income gains of £489k. Our debt advice team have been connected to people in order to support them through the management of their debt, writing off nearly £630k of debt.

We have secured funding to extend the advice service in North Liverpool as a direct result of our work through Money Angels – this work will focus on connecting those over the age of 65 to essential money (welfare benefits and/or debt) advice.

We are also in the final stages of conversations to see the model take root as part of a local authorities anti-poverty action plan in the North East of England. We’re excited by the potential this simple platform has to connect more people to life changing advice.

If you’d like to talk to us about how you could support more people to connect to life changing advice in your context through Angels Connect, please get in touch today.